Frequently Asked Questions

for Hospital Management

First, please read “For Hospitals” in the header “CHC Plans“. There’s a lot of information there. Then these “FAQs“. Lastly, select what you want to do next. Click an “Action Button“.

Thank You for your interest! The FAQs Follow

Because You Must Treat Patients without insurance and the likelihood you won’t get paid.

✓ CHC can turn non-paying Patients into paying Patients. You are required to provide Medical Services to everyone. Even when they have no insurance and likely you won’t get paid.

✓ CHC is an alternative to a hospital bankruptcy: The Hospital’s we’ve talked with are not happy with insurance companies and their payments. They also talk about treating Patients with no insurance, not getting paid and overall profitability. Many are looking for viable options as an alternative to closing or selling to a large hospital group.

CHC is a viable, good option for you to consider.

Below are some of your Non-CHC options:

➪ Increase prices: If the Patient doesn’t pay, increasing prices has no effect on your income.

➪ Get more reimbursements from insurance and federal or state aid programs: This will not likely happen.

➪ Receive Income from related products and services: Some have moved into more specialized Medical Services & Products. Actually, CHC is in this category.

Our Proposal: CHC will provide your Hospital with an on-going financial Subsidy when your Hospital offers the CHC Healthcare Plan to your Patients and other residents and employers in your Community.

Contact us for details and your Subsidy proposal.

Any Hospital! We favor rural Hospitals because of their extreme financial need.

Yes. Legally you are OK. You do not need an insurance license to receive financial Subsidy from CHC.

Reason: We are Subsidizing your Hospital to provide Medical Services for CHC Members that are residents in you Community.

Subsidy Proposal: We offer a liberal Subsidy program for Hospitals who assist us in making the Community Healthcare Cooperative available to Patients in the Community. We’ll describe your Subsidy program in more detail in your proposal.

Contact us for details and a proposal.

Introduction: First, we’re going to use some financial terms. Then give you some examples and show you how it all relates to your Hospital and to your CHC Subsidy Proposal.

Transactional Income is when a business receives payment when they sell a product or a service. With Transactional Income the business gets paid once per transaction. For example, a real estate broker’s commission is a form of Transactional Income. Charging for a medical service is also a Transactional Income.

For purposes of your Proposal, we’ll call this your “Transactional Subsidy”.

Annuity Income is when a business receives on-going income from a sale, usually without doing any additional activities. A monthly Membership Fee is a form of Annuity Income. Hospitals don’t have Annuity Income.

For purposes of your Proposal, we’ll call this your “Annuity Subsidy”.

The Reason for Your Annuity Subsidy:

Your Annuity Subsidy is being paid to reimburse your Hospital for your efforts associated with offering CHC to your Patients.

You receive an Annuity Subsidy for each Patient you sponsor and who joins CHC. The amount of your Annuity Subsidy is based on the type of services your Hospital performs.

You Annuity Subsidy Plan Compensation has Two Options:

✓ Option 1 – Transactional Subsidy: Simply introduce CHC to your patients. For those who have health insurance, ask them if they would like to have a “free”, no obligation review of their healthcare insurance plan.

For those who do not have insurance, ask them if they would be interested in having an affordable healthcare plan.

Collect some basic information and forward to CHC. We will follow-up with each Patient with a no cost CHC Healthcare Affordability Review.

CHC will pay your Hospital a $100 Subsidy for each Patient you assist to purchase a CHC Healthcare Plan.

✓ Option 2 – Annuity Subsidy: With this Option, a Hospital staff person counsels your Patients, does their Quote and takes their application to purchase their CHC Healthcare Plan. If you prefer, a CHC Staff Person will be assigned to your Hospital to perform these functions.

CHC Annuity Subsidy Example: Let’s take a typical 30 year old who has purchased a CHC Healthcare Plan. The monthly price is about $230. The monthly Annuity Subsidy would be $23.00, $276 per year.

Next, by only adding 10 new Patients per month would produce a total, initial, annual Annuity Subsidy for you of over $33,000. And this Annuity Subsidy could continue for many years.

Summary: The Annuity Subsidy has the greatest cash amount and is the longest paying. The Annuity Subsidy is much better than the one-time, Transactional Subsidy.

With either Option it will be a great Service offered by your Hospital to all your Patients and staff.

To Everyone: All your patients, your employees, part-timers, 1099s, volunteers and other affiliates (your “Staff). There are no restrictions.

To all your Patients: Many cannot afford the cost of healthcare. Consider those Patients that you see without insurance. Other Patients may have an employer Group plan. CHC could cut their monthly and Out-of-Pocket cost by 50% or more.

To other people and companies. Consider the persons and companies that regularly interact with you and your Hospital. They all need an affordable healthcare plan.

Help them all get an affordable healthcare plan and we’ll Subsidize your Hospital.

There are two options depending on your level of involvement.

✓ Option 1 – Basic Introduction: Simply introduce CHC. For those Patients who have a health insurance plan, ask them if they would like to have a “free”, no obligation review of their current plan.

For those who do not have insurance, ask them if they would be interested in having healthcare insurance that is affordable. Collect some basic information and forward to CHC.

We will follow-up with each person you refer to us.

✓ Option 2 – Counseling Service: Help your Patients choose the CHC Healthcare Plan’s Coverages and Benefits that meets their needs and budget. Use the CHC Quote form to price the CHC Healthcare Plan. Obtain approval from your Patient to join the CHC and purchase a CHC Healthcare Plan. Prepare an order form and send to CHC for processing.

No! Your Staff and Patients can “Opt-In” or “Opt-Out” at any time.

Yes! Give all your Staff another, more affordable healthcare plan option. Let your Staff decide which healthcare plan they want.

In addition, your Hospital’s Healthcare Plan becomes more valuable and you will have more Staff Opting-In to your Healthcare Plan.

Your Messaging: Tell your Patients you are concerned about their financial health as well as their physical health.

Tell them there is no cost or obligation to receive a healthcare insurance affordability check.

Marketing Materials: All marketing materials are approved by you before use. The marketing material states that you entered into a relationship with CHC to help lower their healthcare costs.

Ask us for samples of the marketing material we have successfully used with other Medical Providers.

HIPAA Does Not Apply: You will not divulge any HIPAA related information to us. Only the Patient’s contact information. We only use medical information disclosed to us by the Patient in order to provide them with a quote.

All medical information will be divulged by the Patient to CHC. In addition, the Patient signs a HIPAA disclosure authorization.

✓ CHC Healthcare Plans are More Affordable than Group Plans: About 50% less expensive per month. Out-of-Pocket costs are about 80% or more less expensive.

✓ Each CHC Plan is Individually Designed by Each Staff Member: Not by an insurance company or the government

✓ Each Staff Member can use any Medical Provider, Any Medical Service, Anywhere in the World: No “In-Network” requirement. No limitations! Included popular coverages: Traditional Medical, Holistic, Dental, Vision, Hearing, Acupuncture, Chiropractic, Labs, Tests & X-Rays, Vaccines, Critical Illness, Medical Transportation and more

✓ Prescription Medications are Reimbursed 100%: No Deductibles or Co-Pays

✓ No Deductibles or Co-Insurance: Only a single, affordable Co-Pay

✓ Each Staff Member Receives Discounts & Financial Subsidies: For Being Healthy, Having a Family, Being a Senior, Having a Low Income.

✓ Financial Subsidies:

Loss of Income Subsidy – If and when your Staff Member loses their income due to a medical event, CHC will pay their CHC Healthcare Plan’s monthly price.

ACA & Group Plan Financial Subsidy – CHC will pay your Staff Member’s ACA or Group plan’s costs when they are diagnosed with a major medical illness and an ACA or Group plan is recommended

✓ Receive the CHC Healthcare Concierge Service: Helps manage the CHC Member’s entire Healthcare Program. Reviews the CHC Member’s bills for possible billing errors. Locates medical service discounts and cost-effective Medical Providers. Answers general healthcare questions.

✓ Get a Community Healthcare Savings Account (CHSA): Each CHC Member gets a CHSA. Our CHSA is similar to a federal HSA with greater benefits. Here’s a key difference. CHC matches the CHC Member’s CHSA Contributions and pays 5% interest on their CHSA balances.

✓ Get Sponsorship Bonuses: Any CHC Member can receive $100 for each person or family they Sponsor who purchases a CHC Healthcare Plan.

✓ Price-Lock Guarantee: No price increase options for up to 3 years.

✓ ✓ Plus More… Contact CHC

Each CHC Healthcare Plan is personalized by each Staff Member

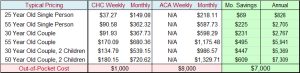

The Following are Representative Prices: One CHC Healthcare Plan, which can be customized by choosing may different options. The CHC prices include popular coverages such as Wellness visits, Dental, Vision, Hearing plus Holistic, Chiropractic, and Acupuncture Medical Services.

ACA & Group Plans only include Wellness visits until the Plan’s Out-of-Pocket costs are met. Dental, Vision, Hearing are extra costs that need to be purchased from other insurance companies. Holistic, Chiropractic, Acupuncture are usually not covered.

Out-of-Pocket Costs: CHC has no Deductible or Co-Insurance Cost. Only a single, affordable Co-Pay with a Maximum of $1,000 Out-of-Pocket cost per Medical Claim.

ACA & Group Plans: The annual Deductible and Co-Insurance Cost is about $8,000. This cost must be paid before the ACA pays any Medical costs. The only exception is an annual Wellness exam. Not Very Affordable!

Note: Because a CHC Healthcare Plan has more coverages than an ACA or Group plan, this is not a true “Apples to Apples” comparison.

See other areas of the Website. Go to the “Header”. Make your selection from the “CHC Plans”.

➪ Read About “For Singles & Families”

➪ Read About “For Employers”

➪ Contact CHC: [email protected]

To Learn More: To see other areas of the Website, Navigate using the “Header Selections”. Visit “FAQs” to get answers to many common questions.

To Contact CHC: Have questions? Want to talk about CHC? Click the Action Button “Contact CHC Concierge Services”.

To Get a Healthcare Quote Now For Yourself, Click the Acton Button “Request Your Healthcare Quote ”.

To Request a Healthcare Quote For Your Organization: Click the Action Button “Contact CHC Concierge Services“. Use the “How We can Help” drop-down to select “Request Your Group Healthcare Quote“. Include any questions or requests. Then “Submit”. We’ll be back to shortly.

To Request Your Subsidy Proposal: Click the Acton Button “Request Your Subsidy Proposal”. Like above, make your selection on the Contact CHC screen.

Thanks for your Continued Interest