Frequently Asked Questions

General FAQs

First, please go to the header “CHC Plans“. Make a selection that best describes who you are. There’s a lot of information there. Then come back to these “FAQs“. Lastly, select what you want to do next. Click an “Action Button“.

Thank You for your interest! The FAQs Follow

The Community Healthcare Cooperative “CHC” is a community-focused, member-funded organization, providing affordable healthcare solutions for individuals, families and employers.

CHC Is similar to an Agricultural Cooperative, which provides a “One-Stop” community service for farmers. CHC is a “One-Stop” healthcare service for you and everyone in your community.

Our Mission: To make healthcare affordable, less financially risky and easier to manage.

A CHC Plan is Affordable: The CHC Healthcare Plan’s monthly cost is about 50% lower than any ACA or Group insurance plan. The CHC Healthcare Plan is not insurance, therefore you are not required to pay for coverages you don’t want.

We only offer one Healthcare Plan. Why not more? The CHC Healthcare Plan includes all Medical Services with no deductibles or co-insurance costs. Just a simple and affordable Co-Pay. That’s the reason we only need to offer one healthcare plan.

Member Services: Every CHC Member receives a personal CHC Healthcare Concierge to help the Member with a wide range of health and cost related issues.

Corporate Headquarters: We’re located in Colorado and offer our CHC Membership & CHC Healthcare Plan anywhere in the U.S. and the World. We’ve been around for over eight years.

Everyone…

✓ Singles & Families including pets

✓ Employers

✓ Medical Providers

✓ Union and Trade Associations

✓ Non-Profit & Religious Organizations

✓ Marketing & Sales Organizations

✓ Community Hospitals

✓ Towns & Communities

First, CHC is a Healthcare Cooperative. Not an insurance company. ACA and Group Plans are insurance plans sold by insurance companies.

CHC’s Healthcare Plan is a new and unique type of healthcare plan. For instance, a CHC Member’s medical bills are paid from a “Healthcare Capital Pool”, which is funded by all CHC Members. CHC manages the Pool for the benefit of the Members.

“People Insuring People“.

CHC provides an affordable healthcare alternative to traditional Affordable Care Act (ACA) health insurance or Group insurance plans. CHC focuses on healthcare affordability and the lowering of your Healthcare financial risk when you need to have a Medical Service.

Here’s how we achieve these objectives

✓ You only purchase the healthcare Coverages and Benefits you want: You design your own Healthcare Plan. You choose and pay only for Coverages and Benefits you want. This lowers your cost!

With traditional healthcare insurance, all plans include coverages that you may not need or even want. Such as maternity coverage for a 60 year-old male. This practice increases your cost!

✓ We establish a direct relationship between you and all Medical Providers: CHC removes the insurance company from the “Payment Path”. Medical Providers are paid on day of service.

In return, Medical Providers give our Members a “Self-Pay, No-Insurance” discount because they don’t have to submit their medical bill to an insurance company. The Medical Provider discounts range from 5% to over 50%. This lowers your cost!

✓ You choose the Medical Providers you want. You get who you want. Not who an insurance company says you must use. Competition lowers your cost!

✓ We eliminated Deductibles and Co-Insurance costs. We replaced both with a single “Shared Responsibility” Co-Pay. Shared Responsibility means you and CHC share the cost charged by the Medical Providers. The Shared Responsibility is 50% for you and CHC.

With an ACA or Group Plan you must pay the Deductible and Co-Insurance cost before the insurance company pays any of your medical bills. The only exception is an annual wellness exam.

✓ We limited your Out-of-Pocket costs. First, by the Shared Responsibility Co-Pay. Next, we limited the Co-Pay to a maximum of only $1,000 per medical claim. In 2022 the typical annual ACA & Group Deductible and Co-Insurance cost is $8,000.

The Result – CHC Healthcare Plans are about 50% less expensive per month and have 80% lower Out-of-Pocket annual costs !

First, look closely at any Group or ACA insurance Plan. The monthly cost for an ACA plan is too expensive for most people.

Next, an ACA or Group plan will have about an $8,000 to $16,000 Deductible and Co-Insurance; Your Out-of-Pocket cost. Most people don’t have the money to pay this cost!

Finally, calculate your “All-In Cost”. Multiply your monthly cost by 12 then add the Out-of-Pocket cost. This is the real cost of your plan.

Example: If your monthly cost is $300 and you have an $8,000 Out-of-Pocket cost. Your All-In Cost is $11,600.

If you have a $10,000 medical cost. You would pay $8,000 and insurance only pays $2,000. Yet, your All-In Cost was $11,600.

With your CHC Plan, you would only pay your Co-Pay. CHC would pay the remaining cost up to your Medical Services Benefit Amount.

CHC can save you thousands of dollars and keep you from having a major financial problem or even a medical bankruptcy.

Faith-Based healthcare plans are sold by organizations whose members share religious beliefs and values and use these as a basis for paying medical expenses. In most cases, to purchase their healthcare plan requires the purchaser to agree to their religious beliefs. Their plans are not insurance.

Members contribute a fixed dollar amount each month to their own savings account. When a member of the community is ill and needs help paying their medical expenses, the person submits a request for the amount needed to cover the bill.

If approved, the request is either paid directly to the healthcare provider by using funds from other members’ savings accounts, from the Pool. Or, members are asked to send money to the member so the member can pay their medical bills.

In many cases, the faith-based organization does not negotiate or review medical bills. What is similar to CHC is the practice of having their members contribute to pay another member’s medical bills.

CHC adds two key business practices usually not found in faith-based organizations. First, CHC gets actively involved to lower the cost of the CHC Member’s medical services. CHC has the Concierge Service to be the CHC Member’s Healthcare Advocate.

CHC also uses other forms of stop-loss insurance to protect the money in the Members Capital Pool. CHC uses best-practices to operate as a successful business and not a faith-based organization. Of course, religious beliefs are not part of CHC’s business practices and rules for membership.

Yes!

In Addition:

✓ No Co-Pays

✓ No Co-Insurance

✓ No Deductibles

✓ Reimbursements up to $1,000 per year

CHC Discounts & Financial Subsidies

✓ Healthy Discounts: If you are healthy, CHC lowers your CHC Plan cost.

✓ Family Discounts: The larger the family the greater the Discount.

✓ Income Subsidies: For Lower income CHC Members.

✓ Loss of Income Subsidy: If and when a CHC Member loses their income due to a medical event, CHC will pay their CHC Healthcare Plan’s monthly price.

✓ ACA & Group Plan Financial Subsidy: CHC will pay a CHC Member’s ACA or Group plan’s costs when they are diagnosed with a major medical illness and an ACA or Group plan is recommended.

Subsidies From Other Sources

✓ Your Employer: Employers frequently subsidize the cost of an employee’s healthcare plan.

✓ Trade Associations, Church and Fraternal Organizations: Let us know your affiliation and we’ll check for subsidies and discounts.

✓ Federal and state governments: Not directly available through CHC. However, CHC can make recommendations.

✓ CHC Healthcare Plans are More Affordable than Group Plans: About 50% less expensive per month. Out-of-Pocket costs are about 80% or more less expensive.

✓ Each CHC Plan is Individually Designed by Each Staff Member: Not by an insurance company or the government.

✓ Each Staff Member can use any Medical Provider, Any Medical Service, Anywhere in the World: No “In-Network” requirement. No limitations!

Included popular coverages: Traditional Medical, Holistic, Dental, Vision, Hearing, Acupuncture, Chiropractic, Labs, Tests & X-Rays, Vaccines, Critical Illness, Medical Transportation and more.

✓ Prescription Medications are Reimbursed 100%: No Deductibles or Co-Pays.

✓ No Deductibles or Co-Insurance: Only a single, affordable Co-Pay.

✓ Each Staff Member Receives Discounts & Financial Subsidies: For Being Healthy, Having a Family, Being a Senior, Having a Low Income.

✓ Financial Subsidies:

Loss of Income Subsidy – If and when your Staff Member loses their income due to a medical event, CHC will pay their CHC Healthcare Plan’s monthly price.

ACA & Group Plan Financial Subsidy – CHC will pay your Staff Member’s ACA or Group plan’s costs when they are diagnosed with a major medical illness and an ACA or Group plan is recommended

✓ Receive the CHC Healthcare Concierge Service: Helps manage the CHC Member’s entire Healthcare Program. Reviews the CHC Member’s bills for possible billing errors. Locates medical service discounts and cost-effective Medical Providers. Answers general healthcare questions.

✓ Get a Community Healthcare Savings Account (CHSA): Each CHC Member gets a CHSA. Our CHSA is similar to a federal HSA with greater benefits. Here’s a key difference. CHC matches the CHC Member’s CHSA Contributions and pays 5% interest on their CHSA balances.

✓ Get Sponsorship Bonuses: Any CHC Member can receive $100 for each person or family they Sponsor who purchases a CHC Healthcare Plan.

✓ Price-Lock Guarantee: No price increase options for up to 3 years.

✓ ✓ Plus More… Contact CHC!

Each CHC Healthcare Plan is personalized by each Staff Member

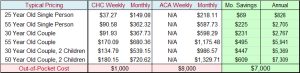

The Following are Representative Prices: One CHC Healthcare Plan, which can be customized by choosing may different options. The CHC prices include popular coverages such as Wellness visits, Dental, Vision, Hearing plus Holistic, Chiropractic, and Acupuncture Medical Services.

ACA & Group Plans only include Wellness visits until the Plan’s Out-of-Pocket costs are met. Dental, Vision, Hearing are extra costs that need to be purchased from other insurance companies. Holistic, Chiropractic, Acupuncture are usually not covered.

Out-of-Pocket Costs: CHC has no Deductible or Co-Insurance Cost. Only a single, affordable Co-Pay with a Maximum of $1,000 Out-of-Pocket cost per Medical Claim.

ACA & Group Plans: The annual Deductible and Co-Insurance Cost is about $8,000. This cost must be paid before the ACA pays any Medical costs. The only exception is an annual Wellness exam. Not Very Affordable!

Note: Because a CHC Healthcare Plan has more coverages than an ACA or Group plan, this is not a true “Apples to Apples” comparison.

Yes! However, persons who have a severe, expensive and long-term medical condition should purchase an ACA insurance plan. These persons would not be eligible for a CHC Healthcare Plan. This practice allows CHC to keep its Healthcare Plan’s prices low and affordable.

Some significant medical issues would be: major heart problems, severe cancer, AIDS/HIV

Contact CHC if you have a significant medical issue to see if you qualify for CHC Membership.

You have two considerations:

✓ Your Budget: First, above all, you need to have a Healthcare Plan that you can afford. You must be able to pay the plan’s monthly cost AND the Out-of-Pocket cost; the Deductible and co-insurance costs. If you can’t afford either, don’t purchase a Healthcare Plan. Contact us for your other options.

If you have a good income, your next consideration is to look closely at “What you Get for what you Pay“. Usually, there is a direct relationship between the cost and the benefits.

We’ll help you do a comparison between CHC and any plan you are considering. Just contact us for help.

✓ The Benefit Amount should cover the cost of your typical Medical Services: Let’s take a look at some statistics. U.S. Government statistics show that the average Non-Routine Medical Services cost about $25,000 or less. This category included major surgeries for knee replacements, shoulder reconstruction, vascular surgery and more.

Here are some interesting examples. A Coronary Artery Stint was billed $141,902. The Medical Provider was paid $12,368 (Boulder Hospital statistics). Knee procedures. One hospital billed $43,672. Was paid $10,704. For the same procedure, another hospital billed $35,846. Was paid $7,964. This shows why you need to get and compare pricing.

There are many such examples. CRAZY!!

So, to answer your question, your CHC Medical Benefit should be under the CHC $25,000 maximum option amount. See below. Call for more information or help with your selection.

✓ Your Options: The CHC Options range from $1,000 to $25,000. The popular choices are $2,500 & $5,000, which will cover all wellness and many non-routine Medical Services. In most cases a $10,000 Medical Benefit is a good balance between cost and most costly, non-routine Medical Services.

For additional information, read the next FAQ.

The Effective Medical Benefit is your Medical Benefit account balance after factoring in Medical provider Discounts & CHC reimbursements. In other words, your Medical Benefit is actually greater than the stated amount because of the Medical Provider Discounts and CHC reimbursements you receive.

Take a look at this Example and read the Explanation for clarification.

Example:

> Your Medical Services Retail Cost: $2,500

> Your Medical Provider CHC Discount (20%): $500

> Your Medical Services Billed Cost: $2,000

> Your Shared Responsibility Co-Pay (50%): $1,000

> Your CHC Medical Reimbursement (50% of Billed Cost): $1,000

> Your Total Savings (Discount + CHC Reimbursement): $1,500

> Your CHC Medical Benefit Amount: $2,500

> Your Medical Benefit Reduction (Your Reimbursement): $1,000

> Your Medical Benefit Account Balance: $1,500

Explanation: Your Effective Medical Benefit amount is your Medical Benefit times the Medical Benefit Multiplier.

As you can see, you only paid $1,000 and only $1,000 was deducted from your Medical Benefit amount. Your Medical Service cost was only $1,000. Yet, you received $2,500 of Medical Services.

This means for each $1,000 you get $2,500 in Medical Services; 2.5 ($2,500 / $1,000). The 2.5 is called your Medical Benefit Multiplier.

This also means your Medical Benefit is effectively 2.5 times greater; $6,500 ($2,500 Times 2.5 = $6,500)

Using this calculation, and assuming the same Discounts & Reimbursements, you could receive about $6,500 in Medical Services.

Only If You Have Major Medical Issues: You should purchase an ACA or Group plan if and when you have a medical condition requiring long term, expensive medical treatment.

Here’s a Tip! If you have a family, and one person has a significant medical condition, have that person purchase an ACA plan. Keep the rest of the family on a CHC Healthcare Plan. This practice would be the most affordable way to proceed.

Split Plans: Have the person with the major medical issue get an ACA or Group Plan. The rest of the family would remain on the CHC Healthcare plan.

We never recommend the entire family be on an ACA or Group Plan. The monthly and Out-of-Pocket costs are too expensive.

Shared Responsibility limits your Out-of-Pocket costs: The Shared Responsibility calculates your Co-Pay. The Co-Pay Max limits your Co-Pay amount.

This is what happens with an ACA or Group Plan

Here is an example – The Medical Situation: Let’s say you break your arm and the Medical Provider’s charges are $10,000. The same year, you have another medical event, and that cost is $3,000.

Here is how a typical Healthcare Insurance plan works: The Medical Provider sends the $10,000 bill to the insurance company. The insurance company has the $10,000 bill reduced to $5,000. You have a $2,000 deductible and a $6,000 Co-Insurance. Your total annual Out-of-Pocket cost is $8,000.

What You Pay: You must pay the full $5,000 because you have not met the $8,000 Out-of-Pocket cost.

Another Medical Event: The two medical events total $8,000. You paid $8,000 and the insurance company paid $0. This is in addition to the expensive yearly cost you paid for the insurance premium.

This is what happens with a CHC Healthcare Plan

This is an example showing how CHC with Shared Responsibility works: Because you are a CHC Member you can receive a “Self-Pay No-Insurance”, discount from the Medical Provider. The Medical Provider reduces your cost from $8,000 to $5,000. Your Shared Responsibility is 50% of the $5,000; $2,500. Your Co-Pay Max is $1,000.

What You Pay: Your Out-of-Pocket cost is only $1,000. The lesser of the Shared Responsibility and your Co-Pay Max.

Another Medical Event: The same Shared Responsibility and Co-Pay Max calculation is made. The Shared Responsibility is 50% of $3,000; $1,500. Your Co-Pay Max limits your cost to $1,000. Your Out-of-Pocket cost for the two medical events total $2,500.

CHC saves you $5,500 compared to a traditional insurance plan where you would pay $8,000.

Here’s the real problem with a Traditional Health Insurance Plan! Most people don’t have $5,000 to pay the first cost, much less the $8,000 cost. People struggle to pay the monthly premium only to be faced with an unaffordable $8,000 or more Out-of-Pocket cost. There’s more, with a family, the Out-of-Pocket cost could be $14,000 or more.

Most people don’t have the money to pay their insurance plan’s deductible and co-insurance cost.

Most people are not aware of this insurance Financial Risk. Avoid this Financial Risk. Purchase a CHC Healthcare Plan !

This is the main reason many people resort to filing a medical bankruptcy.

Purpose: Both of these Financial Subsidies are designed to significantly lower your Out of Pocket costs when you have a major medical issue or loss of income.

✓ ACA & Group Financial Subsidy: For expensive, long term, non-routine medical services you may need to have an ACA or Group Healthcare Insurance plan. If you do, this Coverage pays your ACA or Group plan’s monthly cost.

✓ CHC Financial Subsidy: This Subsidy pays your CHC Plan’s monthly payment when you experience a loss of income resulting from a medical condition.

✓ Maximum Benefit: Each Maximum Benefit Amount is calculated based on the Term Months of coverage you select times the monthly cost for an ACA, Group or your CHC Plan. Note, this is only an estimate, and your ACA / Group cost and Benefit will likely be different.

CHC Plan Options are coverage terms from 1 to 12 months. The popular choice is 6 months. This gives most people time to make other arrangements.

Yes! Just like any other Medical Service.

To the Community Healthcare Capital Pool. Your payment goes to CHC. Your payment is called your “CHC Contribution”. When received, CHC deposits your CHC Contribution into the Community Healthcare Capital Pool (the “Pool”).

The Pool holds your CHC Contribution and those received from other CHC Members. The Pool pays your approved medical bills.

For security purposes, the Pool resides in multiple banks and credit unions. Additional Pools are created to stay within FDIC and NCUA insurance limits.

Just like any company, the Pool could run out of money. However, we use “Stop-Loss” insurance to protect the Pool’s money. Stop-Loss insurance is less expensive than traditional Healthcare Insurance.

If the Pool needs additional capital, because of significant medical claim reimbursements, CHC would use the Stop-Loss insurance and possibly increase the amount CHC Members are paying into the Pool.

No and No:

CHC is a Financial Management Cooperative managing money to be used to pay the CHC Members’ medical bills. CHC is not a healthcare insurance company and the CHC Healthcare Plan is not insurance.

For instance, a “Farmers Cooperative” is not a farmer or an agricultural company. A “Farmers Cooperative” is a management company for farmers providing a wide range of business and financial services needed by the farmers.

CHC is a “Healthcare Cooperative” providing a wide range of healthcare and financial services for people living in the community.

CHC Members: When you join CHC you become a Member of the Community Healthcare Cooperative.

People who purchase health insurance are considered “the Insured” by the insurance company.