Frequently Asked Questions

For Unions & Trade Associations

First, please read “For Union & Trade Associations” in the header “CHC Plans“. There’s a lot of information there. Then these “FAQs“. Lastly, select what you want to do next. Click an “Action Button“.

Thank You for your interest! The FAQs Follow

✓ To Increase Your Income”: Most Associations have two forms of income. Annuity Income from Membership Fees. Transactional Income, a one-time payment, for selling a product or service.

Annuity Income is much better than Transactional Income. That’s why we are proposing a new Annuity Income program for Your Association!

✓ To Provide All Your Members with an Affordable Healthcare Plan: Associations are usually created to source and provide to its Members various business programs and services. To attract new and retain current Association Members means your Association needs to continue to provide programs and services that benefit your Members.

One of the most sought-after employee benefit is affordable healthcare.

That’s why we are proposing a new, affordable Healthcare Plan for Your Members!

The Need: All employers and staff members are facing the same problem. Group Health Insurance is not affordable. Just look at the monthly premium cost. Even with an employer subsidy, the cost is too high. Employee take rates are less than 30% for many companies. And that’s not the biggest problem!

Look at the employee’s Out-of-Pocket costs. In 2022 the average Group plan’s Out-of-Pocket cost is $8,000 or more. Just ask yourself this question, “How many of your employees can afford to pay $8,000 when they need to receive medical services?”

The answer is usually “None”. There needs to be another answer. We have the answer.

The Solution: CHC Healthcare Plans start as low as $62 biweekly. Out-of-Pocket costs (no deductible or Co-insurance) can be as low as $1,000. To see more, look at FAQs about CHC Healthcare Plans.

Association Income: Oh yes, there is income for your Association. CHC has a liberal, “annuity-style”, month after month, compensation plan.

To see how much your Association can earn, contact us for a proposal.

Yes! CHC has a liberal, “annuity-style” Financial Reimbursement plan. Your Financial Reimbursement continues month after month as long as the CHC Healthcare Plan is offered and purchased by your Association’s Members.

CHC will also pay you a Financial Reimbursement when you recommend CHC to any person or company. Think about your suppliers and all persons you come in contact with your business. All need an affordable healthcare plan. You can help them and CHC will compensate you.

Request a Proposal and we’ll describe your Financial Reimbursement program plus show your projected compensation.

You Subsidy Plan Compensation has Two Options:

✓ Option 1 – Transactional Subsidy: Simply introduce CHC to your Members and staff. For those who have health insurance, ask them if they would like to have a “free”, no obligation review of their healthcare insurance plan.

For those who do not have insurance, ask them if they would be interested in having an affordable healthcare plan.

Collect some basic information and forward to CHC. We will follow-up with each Member with a no cost CHC Healthcare Affordability Review.

CHC will pay you a $100 Subsidy for each Member you assist to purchase a CHC Healthcare Plan.

✓ Option 2 – Annuity Subsidy: With this Option, your staff person counsels your Members, does their Quote and takes their application to purchase their CHC Healthcare Plan. If you prefer, a CHC Staff Person will be assigned to your Association to perform these functions.

CHC Annuity Subsidy Example: Let’s take a typical 30 year old who has purchased a CHC Healthcare Plan. The monthly price is about $230. The monthly Annuity Subsidy would be $23.00, $276 per year.

Next, by only adding 10 new Members per month would produce a total, initial, annual Annuity Subsidy for you of over $33,000. And this Annuity Subsidy could continue for many years.

Summary: The Annuity Subsidy has the greatest cash amount and is the longest paying. The Annuity Subsidy is much better than the one-time, Transactional Subsidy.

With either Option it will be a great Service offered by your Association to all your Members and their staff.

To Anyone! Your employees, part-timers, 1099s, volunteers and other affiliates (your “Staff). There are no restrictions.

To other people and companies. Consider the persons and companies that regularly interact with you and your Association. They all need an affordable healthcare plan.

Help them get an affordable healthcare plan and we’ll compensate you for your assistance.

Yes! Give your Staff and your Association Members the CHC healthcare option.

No! Your Staff and Association Members can “Opt-In” or “Opt-Out” at any time.

There are two options depending on your desired level of involvement and compensation.

✓ Option 1: Promote CHC along with any other healthcare plan you are now offering to your Staff and Members.

Offer to do a “Healthcare Affordability Review”. The Healthcare Affordability Review includes a quote and a comparison to their current health insurance plan. Help your Staff and Members complete and send the CHC Healthcare Affordability Review form to CHC. We’ll follow-up with your Members to discuss the results of the Review.

✓ Option 2: Have a staff person perform the Review and discuss the results with your Staff and Members. We’ll train your staff person to conduct the Review. The Review process only takes about 5 minutes. Finalize the sale and send the order to CHC.

By the way, this is how car dealerships work with their clients, when selling new car. They offer to do the client’s financing and insurance.

With either Option it will be another great service offered by your Association to your Staff and Members.

Contact us to discuss these options and compensation.

✓ CHC Healthcare Plans are More Affordable than Group Plans: About 50% less expensive per month. Out-of-Pocket costs are about 80% or more less expensive.

✓ Each CHC Plan is Individually Designed by Each Staff Member: Not by an insurance company or the government.

✓ Each Staff Member can use any Medical Provider, Any Medical Service, Anywhere in the World: No “In-Network” requirement. No limitations!

Included popular coverages: Traditional Medical, Holistic, Dental, Vision, Hearing, Acupuncture, Chiropractic, Labs, Tests & X-Rays, Vaccines, Critical Illness, Medical Transportation and more.

✓ Prescription Medications are Reimbursed 100%: No Deductibles or Co-Pays.

✓ No Deductibles or Co-Insurance: Only a single, affordable Co-Pay.

✓ Each Staff Member Receives Discounts & Financial Subsidies: For Being Healthy, Having a Family, Being a Senior, Having a Low Income.

✓ Financial Subsidies:

Loss of Income Subsidy – If and when your Staff Member loses their income due to a medical event, CHC will pay their CHC Healthcare Plan’s monthly price.

ACA & Group Plan Financial Subsidy – CHC will pay your Staff Member’s ACA or Group plan’s costs when they are diagnosed with a major medical illness and an ACA or Group plan is recommended.

✓ Receive the CHC Healthcare Concierge Service: Helps manage the CHC Member’s entire Healthcare Program. Reviews the CHC Member’s bills for possible billing errors. Locates medical service discounts and cost-effective Medical Providers. Answers general healthcare questions.

✓ Get a Community Healthcare Savings Account (CHSA): Each CHC Member gets a CHSA. Our CHSA is similar to a federal HSA with greater benefits. Here’s a key difference. CHC matches the CHC Member’s CHSA Contributions and pays 5% interest on their CHSA balances.

✓ Get Sponsorship Bonuses: Any CHC Member can receive $100 for each person or family they Sponsor who purchases a CHC Healthcare Plan.

✓ Price-Lock Guarantee: No price increase options for up to 3 years.

✓ ✓ Plus More… Contact CHC!

Each CHC Healthcare Plan is personalized by each Staff Member

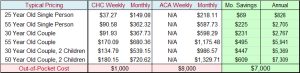

The Following are Representative Prices: One CHC Healthcare Plan, which can be customized by choosing may different options. The CHC prices include popular coverages such as Wellness visits, Dental, Vision, Hearing plus Holistic, Chiropractic, and Acupuncture Medical Services.

ACA & Group Plans only include Wellness visits until the Plan’s Out-of-Pocket costs are met. Dental, Vision, Hearing are extra costs that need to be purchased from other insurance companies. Holistic, Chiropractic, Acupuncture are usually not covered.

Out-of-Pocket Costs: CHC has no Deductible or Co-Insurance Cost. Only a single, affordable Co-Pay with a Maximum of $1,000 Out-of-Pocket cost per Medical Claim.

ACA & Group Plans: The annual Deductible and Co-Insurance Cost is about $8,000. This cost must be paid before the ACA pays any Medical costs. The only exception is an annual Wellness exam. Not Very Affordable!

Note: Because a CHC Healthcare Plan has more coverages than an ACA or Group plan, this is not a true “Apples to Apples” comparison.

See other areas of the Website. Go to the “Header“. Make your selection from the “CHC Plans“.

➪ Read About “For Singles & Families”

➪ Read About “For Employers”

➪ Contact CHC: Concierge@CHChealthcare.org

To Learn More: To see other areas of the Website, Navigate using the “Header Selections”. Visit “FAQs” to get answers to many common questions.

To Contact CHC: Have questions? Want to talk about CHC? Click the Action Button “Contact CHC Concierge Services”.

To Get a Healthcare Quote Now For Yourself, Click the Acton Button “Request Your Healthcare Quote ”.

To Request a Healthcare Quote For Your Organization: Click the Action Button “Contact CHC Concierge Services“. Use the “How We can Help” drop-down to select “Request Your Group Healthcare Quote“. Include any questions or requests. Then “Submit”. We’ll be back to shortly.

To Request Your Subsidy Proposal: Click the Acton Button “Request Your Subsidy Proposal”. Like above, make your selection on the Contact CHC screen.