CHC is a "Must Have" for all Communities

Attn: Mayor & Town Managers

We’d like to provide a Healthcare Subsidy to your Residents and Community Hospital.

Our Introduction: To begin, please read the “Table of Contents” that follows the Action Buttons.

You can Click these “Action Buttons“ to contact us or make a request.

Thanks for Your Continued Interest

Table of Contents

Section 1 – “Why CHC is a Must Have for Your Community’s Residents & Employers”

Section 2 – “Why CHC is a Must Have for Your Staff”

Section 3 – See Sample Pricing; Summary of Your Subsidy Proposal; Learn About CHC and a Business Model You should Adopt; Plus More!

Thanks for Your Continued Interest!

Why CHC is a “Must Have” for Your Community

Traditional healthcare insurance is completely unaffordable for your Community’s Residents.

The Problem Needing to be Solved: Reports show that fewer people have health insurance. Many people avoid medical treatment because they can’t afford the cost of Traditional Health Insurance. Yet, they still need basic wellness and non-routine medical services.

For routine services they want to use their doctor. Others, just put-off seeing a doctor or use a hospital ER.

What do your Medical Providers do? They may offer a non-insurance, self-pay discount. They may even turn your Residents away because they can’t pay. In the case of your hospital they must provide medical services even when the person can’t or doesn’t pay.

In each case, your Residents, Medical Providers and your Hospital are all looking to the Community for a solution to their financial

problems.

This is a significant, community-wide issue that is not being solved.

Our Solution, Your Proposal: We can provide your Residents with an affordable Healthcare Plan that will save them up to 50% on their monthly cost.

More importantly, savings of 80% or more on their deductible and co-insurance costs. CHC also provides financial assistance and subsidies for; being Healthy, having a family, being a Senior, having and Low Income.

Helping Your Residents: Let’s Address their Problems. Offer your Residents some financial help that can save them money and lower their medical bankruptcy risk.

With CHC and your help, we can help all of your Residents. Your Community can be a leader helping all your Community Residents get access to an affordable healthcare plan.

Helping Your Medical Providers and Hospital: We will subsidize their income, which will help them remain in your Community and continue to provide medical services.

Action Item: Offer the Affordable CHC Healthcare plan to All Your Residents & Employers.

Your Hospital likely has a Financial Crisis

There are two main factors causing this Crisis.

First, because of the cost of healthcare insurance, fewer people have insurance. When they have any medical issue, they go to the Hospital ER.

Because hospitals must, by law and commitment, provide their medical services. Your Hospital provides the medical services with little likelihood of getting paid or reimbursed.

This is an unsustainable situation!

Second, those who have insurance must pay the insurance plan’s deductible and co-insurance costs. Which is really the Hospital’s bill.

In 2022, these out-of-pocket costs average about $8,000. Likely, the majority of your residents don’t have $8,000 to pay this cost.

So, for all practical purposes, even people with insurance may not be able to pay their Out-of-Pocket costs or their medical bill, which are the

Hospital bills.

Like above, your Hospital likely will not be paid!

The result, without insurance payments or financial aid from state and federal governments, hospitals will go bankrupt. It’s a fact happening all over the U.S. Likely in your Community as well.

The underlying problem in both cases is money. Money can solve your Community Hospital’s financial problems. The question is, where does the money come from? The answer, from US, the Community Healthcare Cooperative will subsidize your hospital.

Our Proposal: CHC will cash subsidize your Hospital. The CHC Hospital Subsidy program pays your Hospital an on-going, monthly ” Cash Subsidy.

Why would CHC do this? We need your Community Hospital to provide medical services for our Cooperative Members. We want to keep your Hospital operating! It’s just that simple!

To read more about Community Hospitals, go to the “For Community Hospitals” selection in the drop-down menu.

The Problem Needing to be Solved: Reports show two trends. One, fewer people have health insurance. Two, employers and medical providers are leaving smaller towns and community’s. This means communities have a significant medical issue.

✓ Your residents can’t afford the cost of traditional health insurance. So they use the local hospital for all types of medical services.

✓ Many employers can’t afford to offer or subsidize a Group Insurance plan. Yet, their employees still need basic wellness and non-routine medical services. For routine services they want to use their doctor or they use the hospital ER.

✓ Many rural hospitals are close to bankruptcy. Because of the above situation.

✓ Your medical providers have fewer paying patients. This results in closures and movement out of your Community.

✓ The result: Your community has fewer medical services. Residents and employers leave your Community. Your Community can’t attract new residents or employers. Your Community becomes a less desirable place to live.

This is a significant, community-wide issue that is not being solved. Until Now!

Our Solution, Your Proposal

✓ Offer an Affordable Healthcare Plan: To all your resident and employers

✓ Helping Your Residents: Offer an Affordable Healthcare Plan to all your Residents and employers. We can provide your Residents with an affordable Healthcare Plan that will save them up to 50% on their monthly cost.

More importantly, a savings of 80% or more on their deductible and co-insurance costs. CHC also provides financial assistance and subsidies for; being Healthy, having a family, being a Senior, having and Low Income.

To Learn More, select “For Singles & Families”, from the “CHC Plans” drop-down list.

✓ Helping Your Employers: With CHC, your employers can offer an Affordable Healthcare Plan to all their staff without the need to subsidize the plan’s cost. To Learn More, select “For Employers”, from the “CHC Plans” drop-down list.

✓ Helping Your Hospital: CHC will subsidize the cost of operating the hospital. To Learn More, select “For Community Hospitals”, from the “CHC Plans” drop-down list.

You were elected or appointed to serve your Community

Summary: Rural America has a major problem keeping hospitals and other medical providers operating and in the Community. Your Residents must have local medical services.

City and town officials were hired or elected to provide for the welfare of Community’s citizens.

Think About How CHC Can Change Your Community’s financial future!

What’s your plan to address your Community’s problem? The Clock’s Ticking!

You Subsidy Proposal has Two Options

✓ Option 1 – Transactional Subsidy: Simply introduce CHC to your Citizens and Employers. For those who have health insurance, ask them if they would like to have a “free”, no obligation review of their healthcare insurance plan.

For those who do not have insurance, ask them if they would be interested in having an affordable healthcare plan.

Collect some basic information and forward to CHC. We will follow-up with each person or company with a no cost CHC Healthcare Affordability Review.

CHC will pay you a $100 Subsidy for each person or family that you assist to purchase a CHC Healthcare Plan. More Subsidy for an Employer who joins CHC.

✓ Option 2 – Annuity Subsidy: With this Option, a Community staff person counsels your your Citizens and Employers, does their Quote and takes their application to purchase their CHC Healthcare Plan. If you prefer, a CHC Staff Person will be assigned to your Community to perform these functions.

CHC Annuity Subsidy Example: Let’s take a typical 30 year old who has purchased a CHC Healthcare Plan. The monthly price is about $230. The monthly Annuity Subsidy would be $23.00, $276 per year.

Next, by only adding 10 new Members per month would produce a total Annuity Subsidy for you of about $18,000. And this Annuity Subsidy could continue for many years.

An employer with 25 employees who join CHC could give you an Annual Subsidy of over $70,000 per year.

Summary: The Annuity Subsidy has the greatest cash amount and is the longest paying. The Annuity Subsidy is much better than the one-time, Transactional Subsidy.

Employees, Part-Timers, 1099s, Volunteers, Affiliates

✓ No Classification or Age Limitations: If they work for you, they can be included.

✓ Include Family Members: Adopted & Extended families, grandparents, aunts, uncles even pets can be included at an affordable price. Unlike Group plans.

✓ No “Open-Enrollment”: Your Staff can “Opt-In” or “Opt-Out” at any time.

✓ CHC Healthcare Plans are Portable: Each Staff Member can take their CHC Healthcare with them when they leave. No need for COBRA!

✓ CHC Healthcare Plans are Effective in 24 Hours

Everyone Needs an affordable Healthcare Plan that can be tailored to their needs and budget

Your Staff’s Dilemma: Traditional and Group healthcare insurance have become completely unaffordable for everyone, including your Staff and your Practice.

Here’s How We Can Help: We can provide your Staff Members with an affordable Healthcare Plan that will save them up to 50% on their monthly cost. More importantly, savings of up to 80% on their deductible and co-insurance costs. CHC also provides financial assistance, low income subsidies, healthy and family discounts.

Take a Look

Lower Your Staff’s Monthly Healthcare Plan Cost by 50%: Your Staff choose and pay only for the coverages they want. Each Medical Service is subsidized by CHC. Each Staff Member can receive discounts for being Healthy, having a Family, being a Senior, or having a Lower Income.

This is the main reason you don’t need to subsidize a CHC Healthcare Plan

Lower your Staff’s Out-of-Pocket Costs by 80%: CHC has no Deductibles or Co-Insurance costs. Just one, affordable Co-Pay.

A typical Group plan’s Out-of-Pocket cost is over $8,000. Likely, most of your Staff can’t pay this cost. This means you are offering, and they are buying, a healthcare plan they can’t afford to use.

This is the main reason for Medical Bankruptcies

Give Your Staff More Benefits & Coverages: Many Group plan’s do not include important Coverages. Dental, Vision, Hearing usually must be purchased separately. Holistic and other types of wellness and medical treatments are not covered or even available. All are included with CHC!

Each Staff Member can personalize their own CHC Healthcare Plan: Not so with a Group plan. An 18 year-old, single person, has far different healthcare requirements than a 50 year-old with a family of 4. Unlike a Group plan, which is “one-size-fits-all”, a CHC Plan is personalized by each Staff Member to meet their needs and budget.

Each Staff Member can receive Prescription Medications Reimbursed 100%: No so with a Group plan. With CHC, No Co-Pay, No Deductible, No Co-Insurance.

Compare CHC to any Healthcare Plan

Suggestion: If you have a Group plan, take a few minutes to read it. Take a close look at the monthly and the annual Out-of-Pocket cost. We think you’ll be surprised at the costs!

The most sought-after employer benefit is affordable healthcare.

The Issue: Traditional Group healthcare insurance is completely unaffordable for you and your Staff. Yet, employees believe and want their employer to offer an affordable healthcare plan.

Employers are all looking for an alternative to expensive Group insurance. Your Staff are looking for ways save money and to lower their healthcare medical costs.

The Solution: Offer all your Staff an affordable CHC Healthcare Plan. The CHC Healthcare Plan is 50% or more less expensive than any Group Plan. So much so there is no need for you to subsidize the monthly cost.

Give your Staff financial help that saves them money and lowers their medical and healthcare costs and you’ll have a satisfied Staff who will want to stay with you.

The more your Staff seeing you helping them, the more likely they will remain with your company.

For the first time you can use an employee benefit program to recruit new Staff Members without it costing you anything.

Take Look …..

✓ Any Staff Member can purchase a CHC Healthcare Plan. Part-timers, 1099s, volunteers and affiliates. If you want them on your CHC Plan, they can be included!

✓ Your Staff can easily add family members, even their pets. To add is affordable. Not so with a Group insurance plan.

✓ CHC Healthcare plans are 50% less expensive than any Group insurance plan. No need to subsidize!

✓ There are no Deductibles or Co-insurance costs. Just a single, affordable Co-Pay.

✓ Out-of-Pocket costs are limited to only $1,000 per medical claim. Not an $8,000 Annual Out-of-Pocket Cost like most Group plans.

Start Offering a New and Great Employee Benefits Program Today!

How We Do it – So You Don’t Have To

✓ Your Staff Receive Medical Provider Discounts: From about 10% to 50% or more on each Medical Service

✓ Your Staff Receive Cash Reimbursements from CHC: 50% on each Medical Service

✓ Your Staff Receive Discounts & Subsidies: For Being Healthy, Having a Family, Being a Senior, Having a Low Income

CHC is Giving Your Staff Discounts and Financial Subsidies So You Don’t Have To

CHC Healthcare Plans are Affordable for All Your Staff

Your Dilemma: If you are offering a healthcare plan, you are likely subsidizing your Staff’s monthly cost. We can eliminate this need and cost because the CHC price is so affordable.

Your Group Plan’s Low Take-Rate: If you are offering a Group Plan, likely you have a low take-rate. This is usually because of your Group Plan’s cost. Give your Staff a more affordable healthcare plan option and you’ll see a higher Take-Rate.

Your Opportunity: If you are not offering a healthcare plan, now is the time! With CHC you can offer a great healthcare plan without it costing you any money.

CHC is Better Than a Raise: Consider, lowering your Staff’s healthcare cost is just like giving them a raise, only better. CHC doesn’t cost you anything. A raise does!

Offering the CHC Healthcare Plan: Offer the CHC Healthcare Plan as a Stand-Alone healthcare plan or along with a Group healthcare plan. Let your Staff decide which plan they want.

Get out of the Healthcare Hassle and Back to Running Your Business

Your Dilemma: When offering a healthcare plan, your staff have many questions. How does it work? What’s my options? What medical providers can I use? Where do I send my bills? These are just a few. My guess is you can add to this list

Your Response: You either have an HR person answer the questions or you have to do it yourself. Now is the time to add another option that gets rid of the previous issues.

Your New Option: Have us manage your entire healthcare plan for you. Each Staff Member has access to their personal CHC Healthcare Concierge.

The CHC Concierge will:

✓ Reviews Your Staff Member’s medical bills for possible billing errors

✓ Checks to see if your Staff Member is receiving medical service discounts

✓ Negotiates payment terms with Medical Providers

✓ Helps your Staff locate cost-effective Medical Providers

✓ Help your Staff with general healthcare questions

To Learn More: To see other areas of the Website, Navigate using the “Header Selections”. Visit “FAQs” to get answers to many common questions.

To Contact CHC: Have questions? Want to talk about CHC? Click the Action Button “Contact CHC Concierge Services”.

To Get a Healthcare Quote Now For Yourself: Click the Acton Button “Request Your Healthcare Quote ”.

To Request a Healthcare Quote For Your Organization: Click the Action Button “Contact CHC Concierge Services“. Use the “How We can Help” drop-down to select “Request Your Group Healthcare Quote“. Include any questions or requests. Then “Submit”. We’ll be back to shortly.

To Request Your Donation Proposal: Click the Acton Button “Request Your Subsidy Proposal”. Like above, make your selection on the Contact CHC screen.

Why CHC is a “Must Have” for Your Staff

✓ No “In-Network” Requirement or Limitations

✓ Use any Medical Provider: Even Specialists and “Holistic” Medical Providers.

✓ Included Popular Coverages: Dental, Vision, Hearing, Holistic, Acupuncture & Chiropractic.

✓ Prescription Medications are Reimbursed 100%

✓ Coverage anywhere in the World

✓ No Co-Pay

✓ No Co-Insurance

✓ No Deductible

✓ Reimbursements up to $1,000 per year

From Medical Providers

For CHC Members and other people who pay on day of service.

✓ Primary Care and Urgent Care facilities: 5% to 30%.

✓ Medical Specialists: To 50%.

✓ Hospitals:To 90%.

From CHC

✓ Healthy Discount: For persons in good health.

✓ Family Discount: For Families. The larger the family, the greater the Discount.

✓ Senior Discount: For persons over 55.

✓ Income Subsidy: For persons with a lower income.

✓ Loss of Income Subsidy: If and when the CHC Member loses their income due to a medical event, CHC will pay their CHC Healthcare Plan’s monthly price.

✓ ACA Or Group Plan Subsidy: If and when the CHC Member purchases an ACA or Group insurance plan due to a significant medical condition.

CHC Eliminated Deductibles & Co-Insurance costs

Replaced with a Single, Affordable Co-Pay

Most Group insurance plans have an annual Out-of-Pocket cost of $8,000 or more.

Think about this: Can any Staff Member afford to pay a Group Plan’s $8,000 Deductible & Co-Insurance cost when they need to use their Group insurance plan? Likely not!

So why have a Group insurance plan they can’t afford to use?

That’s the question!

✓ Your CHC Healthcare Plan price will not increase

✓ The prices for Coverages & Benefits will not increase

✓ Your Staff can add additional Coverages & Benefits at any time at today’s price

CHC Plans are Portable

✓ Loss of Coverage: Better and less expensive than “Cobra”

✓ Each Plan is Personalized and Owned by Each Staff Member: This makes their Healthcare Plan “Portable”.

Your Personal Healthcare Advocate

✓ Reviews your Staff’s medical bills for possible billing errors. Most medical bills have Billing errors and missing discounts.

✓ Reviews to see if your Staff Member is getting medical service discounts. Lowers their Medical Services cost.

✓ Negotiates payment terms with Medical Providers. Another method to lower medical service costs.

✓ Helps your Staff locate cost effective Medical Providers. We have suggestions on which Medical Providers will give good discounts.

✓ Helps your Staff with general healthcare questions. So you don’t have to.

✓ Include Any Family Member: Adopted & Extended families, grandparents, aunts, uncles all at an affordable price. Unlike Group plans.

✓ Include Their Pets: They are Family Too!

✓ No Age or Other Limitations: If they want someone on their CHC Plan, they can be included. No cost to you!

To Learn More: To see other areas of the Website, Navigate using the “Header Selections”. Visit “FAQs” to get answers to many common questions.

To Contact CHC: Have questions? Want to talk about CHC? Click the Action Button “Contact CHC Concierge Services”.

To Get a Healthcare Quote Now For Yourself, Click the Acton Button “Request Your Healthcare Quote ”.

To Request a Healthcare Quote For Your Organization: Click the Action Button “Contact CHC Concierge Services“. Use the “How We can Help” drop-down to select “Request Your Group Healthcare Quote“. Include any questions or requests. Then “Submit”. We’ll be back to shortly.

To Request Your Donation Proposal: Click the Acton Button “Request Your Subsidy Proposal”. Like above, make your selection on the Contact CHC screen.

Thanks for your Continued Interest

To Learn More

You were elected or appointed to serve your Community

Rural America has a major problem keeping hospitals and other medical providers operating and in the Community. Your Residents must have local medical services.

City and town officials were hired or elected to provide for the welfare of Community’s citizens. What’s your plan to address your Community’s problem? The Clock’s Ticking!

Our Proposal: Receive a Cooperative Subsidy to support your Community: Individuals, Families, Employers, Hospital and all Medical Providers.

Think About How CHC Can Change Your Community’s financial future!

Introduction: First, we’re going to use some financial terms. Then give you some examples and show you how it all relates to your Community and to your CHC Subsidy Proposal.

Transactional Income is when a business receives payment when they sell a product or a service. With Transactional Income the business gets paid once per transaction. For example, a real estate broker’s commission is a form or Transactional Income.

For purposes of your Proposal, we’ll call this your “Transactional Subsidy”.

Annuity Income is when a business receives on-going income from a sale, usually without doing any additional activities. A monthly Membership Fee is a form of Annuity Income.

For purposes of your Proposal, we’ll call this your “Annuity Subsidy”.

You Subsidy Proposal has Two Options

The Reason for Your Subsidy: Your Subsidy is being paid to reimburse you for your costs associated with offering CHC to your Residents & Employers.

You receive a Subsidy for each person you sponsor and who joins CHC. The amount of your Subsidy is based on the type of services you perform.

✓ Option 1 – Transactional Subsidy: Simply introduce CHC to your Residents & Employers. For those who have health insurance, ask them if they would like to have a “free”, no obligation review of their healthcare insurance plan.

For those who do not have insurance, ask them if they would be interested in having an affordable healthcare plan.

Collect some basic information and forward to CHC. We will follow-up with each Residents & Employers with a no cost CHC Healthcare Affordability Review.

CHC will pay you a $100 Subsidy for each person or family that you assist to purchase a CHC Healthcare Plan.

✓ Option 2 – Annuity Subsidy: With this Option, a staff person counsels your Residents & Employers, does their Quote and takes their application to purchase their CHC Healthcare Plan. If you prefer, a CHC Staff Person will be assigned to your Practice to perform these functions.

CHC Annuity Subsidy Example: Let’s take a typical 30 year old who has purchased a CHC Healthcare Plan. The monthly price is about $230. The monthly Annuity Subsidy would be $23.00, $276 per year.

Next, by only adding 10 new persons per month would produce a total Annuity Subsidy for you of about $18,000. And this Annuity Subsidy could continue for many years.

Summary: The Annuity Subsidy has the greatest cash amount and is the longest paying. The Annuity Subsidy is much better than the one-time, Transactional Subsidy.

With either Option it will be a great Service offered by You to all your Residents, Employers and other persons you serve.

How Car Dealerships Make More Money than Selling Cars

Their Business Model: Long ago car dealerships learned that just selling cars was not enough. They began offering insurance and financing, which allowed them to sell more cars and significantly increase their dealership’s income.

Dealerships created the Finance and Insurance (F&I) department. After the “Car Sale” the F&I person sells Finance and Insurance. F&I created a major income stream for the dealership.

In many cases, the FYI “Annuity Income” is greater than the “Transactional Income” from the sale of the car.

How Your Association can use this Successful Business Model

Create a “Member Services” Office: The same business model can be adopted by your Association. Offer the CHC Healthcare Plan to every Association Member. Add a dedicated staff person or have CHC provide the staff person.

Your Opportunity: Your Association has thousands, maybe even hundreds of thousands, of dollars of potential income you not receiving today.

Every resident in your Community needs affordable healthcare. Your position in the Community is excellent to offer everyone in your Community an affordable CHC Healthcare Plan.

We’ll show you how to turn this potential income into actual cash

✓ CHC Healthcare Plans are More Affordable than ACA and Group Plans: About 50% less expensive per month. Out-of-Pocket costs are about 80% or more less expensive.

✓ Each CHC Plan is Individually Designed by and for You: Not by an insurance company or the government.

✓ You can use any Medical Provider, Any Medical Service, Anywhere in the World: No “In-Network” requirement. No limitations!

Included Popular Coverages: Traditional Medical, Dental, Vision, Hearing. Plus Holistic, Acupuncture, Chiropractic, Labs, Tests & X-Rays, Vaccines, Medical Transportation and more.

✓ Prescription Medications are Reimbursed 100%: No Deductibles or Co-Pays.

✓ No Deductibles or Co-Insurance: Only a single, affordable Co-Pay.

✓ You Receive Plan Discounts From Medical Providers: For CHC Members and other people who pay on day of service. 5% to 30% from Primary Care and Urgent Care facilities. Specialists, more. To 90% for Hospitals.

✓ You Receive Plan Discounts from CHC: For Being Healthy, Having a Family, Being a Senior, Having a Low Income.

✓ Financial Subsidies:

Loss of Income Subsidy – If and when you lose your income due to a medical event, CHC will pay your CHC Healthcare Plan’s monthly price.

ACA & Group Plan Financial Subsidy – CHC will pay your ACA or Group plan’s costs when you are diagnosed with a major medical illness and an ACA or Group plan is recommended.

✓ Receive your personal CHC Healthcare Concierge: Helps you manage your entire Healthcare Program. Reviews your bills for possible billing errors. Locates medical service discounts and cost-effective Medical Providers. Answers your healthcare questions.

✓ Get a Community Healthcare Savings Account (CHSA): Our CHSA is similar to a federal HSA with greater benefits. Here’s a key difference. CHC matches your CHSA Contributions and pays you 5% interest on your CHSA balances.

✓ Get Sponsorship Bonuses: You can receive $100 for each person or family you Sponsor who join and purchase a CHC Healthcare Plan.

✓ Price-Lock Guarantee: No price increase options for up to 3 years.

✓ ✓ Plus More… Contact CHC!

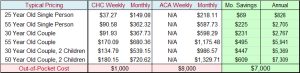

The Following are Representative Prices: One CHC Healthcare Plan, which can be customized by choosing may different options. The CHC prices include popular coverages such as Wellness visits, Dental, Vision, Hearing plus Holistic, Chiropractic, and Acupuncture Medical Services.

ACA & Group Plans only include Wellness visits until the Plan’s Out-of-Pocket costs are met. Dental, Vision, Hearing are extra costs that need to be purchased from other insurance companies. Holistic, Chiropractic, Acupuncture are usually not covered.

Out-of-Pocket Costs: CHC has no Deductible or Co-Insurance Cost. Only a single, affordable Co-Pay with a Maximum of $1,000 Out-of-Pocket cost per Medical Claim.

ACA & Group Plans: The annual Deductible and Co-Insurance Cost is about $8,000. This cost must be paid before the ACA pays any Medical costs. The only exception is an annual Wellness exam. Not Very Affordable!

Note: Because a CHC Healthcare Plan has more coverages than an ACA or Group plan, this is not a true “Apples to Apples” comparison.

The Community Healthcare Cooperative “CHC” is a community-focused, member-funded organization, providing affordable healthcare solutions for individuals, families and employers.

CHC Is similar to an Agricultural Cooperative, which provides a “One-Stop” community service for farmers. CHC is a “One-Stop” healthcare service for you and everyone in your community.

Our Mission: To make healthcare affordable, less financially risky and easier to manage.

Corporate Headquarters: We’re located in Colorado and offer our CHC Membership & CHC Healthcare Plan anywhere in the U.S. and the World. We’ve been around for over eight years.

People Insuring People is Who We Are

If you are offering a healthcare plan:

✓ Why are you offering a healthcare plan that the majority of your Staff can’t afford to use? How many of your Staff can pay an $8,000 Out-of-Pocket cost?

✓ If you have a Group plan, why is your Staff Participation rate so low? Cost is the usual reason !

If you are not offering a healthcare plan:

✓ If you have not offered a Company Healthcare plan, why not? With CHC you now can because you don’t need to subsidize the plan.

✓ If you offered an affordable healthcare plan do you believe you could retain and recruit top-notch staff ? Likely !

✓ If you could eliminate the need to subsidize your healthcare plan, would you ? Increase your income. Use for other purposes.

✓ Reports show that fewer companies offer a health plan. Yet, their employees believe and want their employer to offer an affordable healthcare plan.

What do you want to do?

To Learn More: To see other areas of the Website, Navigate using the “Header Selections”. Visit “FAQs” to get answers to many common questions.

To Contact CHC: Have questions? Want to talk about CHC? Click the Action Button “Contact CHC Concierge Services”.

To Get a Healthcare Quote Now For Yourself, Click the Acton Button “Request Your Healthcare Quote ”.

To Request a Healthcare Quote For Your Community Office: Click the Action Button “Contact CHC Concierge Services“. Use the “How We can Help” drop-down to select “Request Your Group Healthcare Quote“. Include any questions or requests. Then “Submit”. We’ll be back to shortly.

To Request Your Affiliation Subsidy Proposal: Click the Acton Button “Request Your Subsidy Proposal”. Like above, make your selection on the Contact CHC screen.

Thanks for your Continued Interest !

Testimonials

What Our Customers Are Saying!

Customer Satisfaction Is Our #1 Priority